Posted on: 4th February 2016 by Kyle Smith

The use of external aluminium consultants provides a good example of how outsourcing can compliment an existing team to provide, not only a reality check on how the market place is moving in general, but also fresh ideas. Within the narrower focus of production demand, the broader perspective and objective analysis occasionally gets lost. The use of knowledgeable external team members helps generate renewed enthusiasm, enforces the most productive concepts and ensures that the resources are put into those areas that are jointly defined as high priority and where investments can be most usefully made.

Many smaller aluminium rolling companies have in past years been able to offset the advantages of being associated with the larger multi-national companies (with their access to shared resources and cumulative experience) by exploiting the ability to supply to niche markets, to supply small lot sizes, and to provide a more tailored end-product. However, one penalty of being a small independent supplier is a degree of isolation from the changes there may have been within the industry and what global customers expect to be delivered. Baseline assessment of what is possible using the equipment and procedures a plant has in place is much more difficult without some access to comparative information.

One such company, a manufacturer of strip & foil products, approached us to carry out an audit within its foil plant and provide an objective assessment of their foil rolling operations and performance. Such exercises are useful because external aluminium consultants can provide a different perspective on what can sometimes be an isolated introspective view of the technology and manufacturing methods within a plant.

What we did to help

A process flow diagram is the starting point in a project such as this as it identifies the key steps including the source of the foilstock. Once the flow diagram is prepared, it is used as a template on which volumes, recovery & productivity values can be added to provide a map of some of the key manufacturing metrics.

In this particular case Innoval’s experience was used to consider the entire process, rather than just the final machine centre, as well as the overall quality and productivity. This highlighted the need to quantify better some of the metrics relating to the incoming material to ensure it met the quality needs of an ambitious and improving operation. The foilstock specifications were reviewed and revised. After working with the various foilstock suppliers, one was discontinued as it was unable to meet consistently the profile targets and cleanliness requirements demanded of the product in its final form.

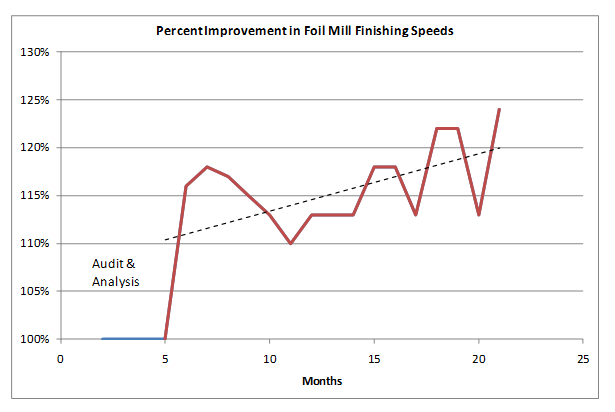

The audit looked very closely at the productivity figures through the foil operations. This identified opportunities to optimise productivity both through increased mill speeds and through reduced handling & down time. The improvements in mill speed had to be done in such a way that the product quality – flatness, surface finish and winding conformance – was not reduced. Determining what could be achieved in practice was a joint activity combining the plant’s experiences with their mills and the accumulated knowledge from Innoval’s aluminium consultants. Decisions were arrived at collectively, trialled and then put into standard practice. The success in implementing this is shown in the chart below:

Though the performance figures shown look impressive, this was only part of the story as the audit looked at the overall plant performance and not just at a couple of machine centres. Improvements to the roughing mill handling were initiated by an analysis of dead time at that machine centre and then successfully implemented. Attention was also paid to the loading of the machine centres and to the optimisation of transfer gauges between the mills. An extensive improvement program was carried out by the process engineers, which has contributed to the overall plant performance figures. This allowed the plant to steadily improve its foil products and the plant output.

Next steps

The growth is now threatening to outstrip the capacity of the machine centres, and several models have been put together by both companies to consider possible business & investment scenarios for the next few years. The models indicate where it is most advantageous to invest in the plant. They include as inputs the business sales projections, the profit margins of the different product groups and the practical as well as engineered capabilities of the existing equipment. This needs to be multiplied by the added value of the product and weighted by the strategic importance of an individual product within the product portfolio.

This blog post was originally written by Dan Miller who has now left the company. Please contact Kyle Smith if you have any questions.